ObamaLegacyPart5 <– PDF

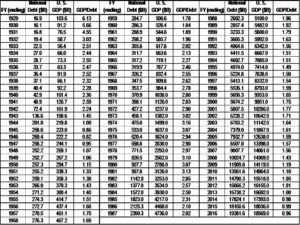

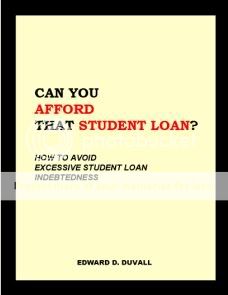

In closing out Mr. Obama’s domestic agenda, we come to the state of the national debt. The national debt had been growing for many years, but it reached and surpassed a critical point during Mr. Obama’s tenure. It is true that President’s are not directly responsible for the nation’s debt (because only Congress can authorize a budget), but Presidents can use their influence to restrain the worst instincts of Congress. Mr. Obama did nothing but encourage Congress’ reckless spending. Figure 1 shows the nation’s GDP, total national debt, and ratio of GDP to debt for the years 1929 to 2016 in current-year dollars. The ratio of GDP to debt is an important indicator of the nation’s liabilities compared to its total economic activity; higher is better. These figures are not exactly in alignment, since the debt figures are for fiscal years, and the GDP values are for calendar years. The general trend is accurate.

Figure 1: GDP, National Debt, and GDP-to-Debt Ratio, 1929 – 2016

Figure 2 shows the ratio of debt to GDP for the same interval. When Hoover entered office in 1929, the nation’s finances were in excellent shape, as the GDP-to-debt ratio was over six. Then came the Great Depression, which nitwit Hoover made worse with his bad policies. The GDP-to-debt declined drastically in the early 1930’s. It was left to the even bigger nitwit Roosevelt to extend the depression to 1940 with his even worse policies, although the GDP-to-debt remained fairly static around 2.5 from 1934 to 1940. It was not until Hitler rescued Roosevelt by starting World War II that the American economy came back to life. The downside in financial terms is that the expansion of production was paid for by adding it onto the debt.. The GDP to debt ratio reached its all-time low in 1946 (0.82), just after the enormous debts accumulated during World War II. From the Truman to Nixon administrations, the debt increased, but GDP increased faster, and the GDP to debt ratio steadily improved, reaching 3.16 in 1974. It remained fairly steady until the halfway through Reagan’s first term; it then began a long slow protracted decline until halfway through the Clinton administration. It improved a bit from there until about 2007, the second-last year of Bush Jr. administration, and then resumed its steady decline until sinking below 1.0 in 2014. It is interesting to observe that one can draw a straight line from 1994 to 2011 and end up in the same place. It has continued a slight decline since 2014.

Many economists consider a GDP-to-debt ratio to be an accurate indicator of high risk. It is comparable to a household with debt equal to an entire year’s income. In the long run, it is unsustainable.

So the U. S. financial condition is now about where it was in 1947. But there is a big difference between the federal government obligations in 1947, wherein it began a long period of improvement, and now. In 1947, there was no Medicare, no Medicaid, no Obamacare with its subsidies, no extensive social spending, no pervasive meddling bureaucracy to be paid, and Social Security was only a small item in the budget. Mr. Obama was content to let the financial condition deteriorate without making some sort of attempt to get back on a sound financial footing. We can only hope that Mr. Trump will not make the same mistake.

Figure 2: GDP-to-Debt Ratio, 1929-2016